Joomla!

Using the installed plugin for Joomla! your customers will be able to pay with you through the payment page of «Sberbank».

The payment plugin requires a previously installed Joomla! extensions for creating an online store. You can use the following extensions:

- VirtueMart (external link);

- JoomShopping (external link).

The table below shows the steps required to review, install and configure the corresponding plugins.

| Component | Actions |

|---|---|

| VirtureMart | |

| JoomShoop |

VirtueMart

Downloading the plugin for VirtueMart

This tutorial assumes that your Joomla! the VirtueMart component is already installed.

The plugin archive differs depending on the version of Joomla you are using! and VirtueMart add-ons (see table below).

The plugins are only guaranteed to work with the following combinations of Joomla! and VirtueMart add-ons. If you use other combinations of versions (for example, after updating Joomla!) The plugin may not work correctly.

| The Joomla! Version | VirtueMart version | Download button |

|---|---|---|

| 2.5 | 2.6.14 | |

| 3.4 | 3.x | |

| 3.6.5 | 3.x |

Starting from this version, the plugin allows you to transfer a shopping cart, which provides the possibility of detailed fiscalization in accordance with 54-FZ. |

From the VirtueMart developer site you can download the Joomla! distribution with pre-installed add-on VirtueMart. The names of such combined archives end with Stable-Full_Package.zip. When doing this, choose a combination of Joomla! and VirtueMart, compatible with the payment plugin.

Installing the plugin for VirtueMart

Installing and configuring the plugin is presented on Joomla! version 3.6.5 and VirtueMart version 3.2.0.

- Log in to the admin panel.

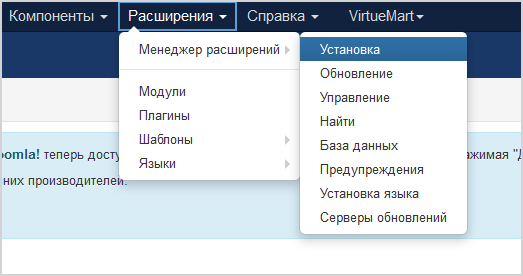

- From the top menu select Extensions> Manage> Install (see image below).

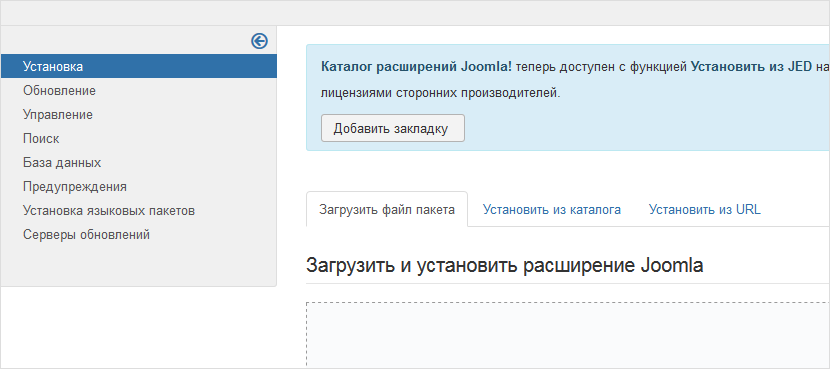

The page will look as follows.

- Make sure the Upload package file tab is selected in the center of the window.

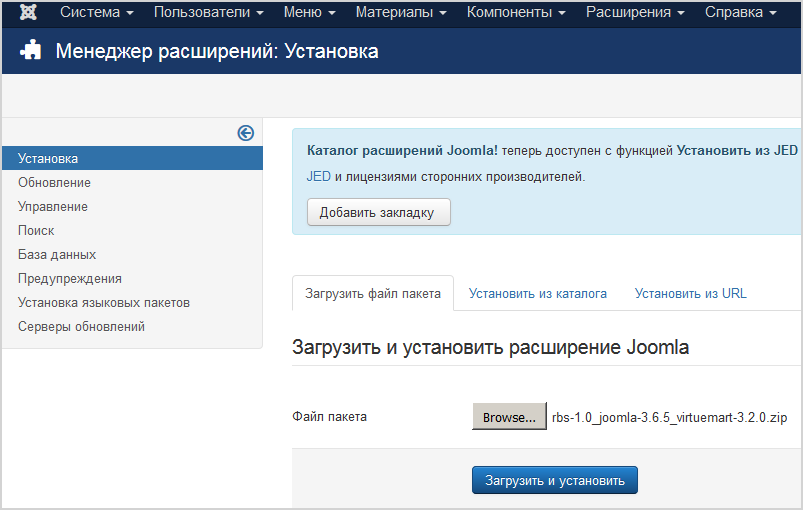

- Click on the button to select the file to upload in the Upload & Install Joomla Extension section, then specify the path to the plugin file and confirm your choice.

- In the window that appears, specify the path to the payment plugin archive.

The archive file name will be displayed in the line Package file.

- Click on the Download and install button.

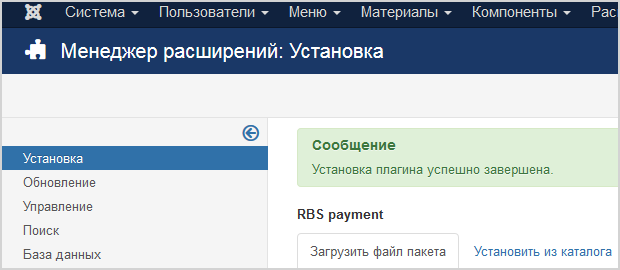

If the installation is successful, a corresponding message will be displayed (see the image below).

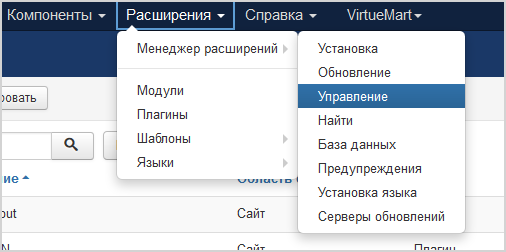

- From the top menu select Extensions> Manage> Manage (see image below).

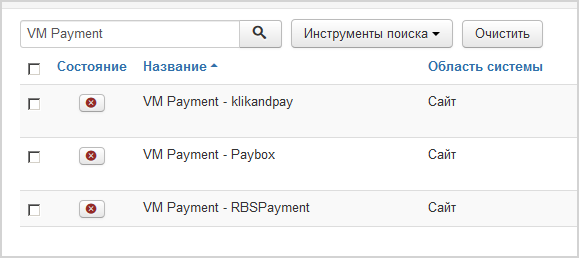

- In the displayed list, find the item in the listVM Payment – RBSPayment (see image below).

- Check the box next to this item and click on the button Enable.

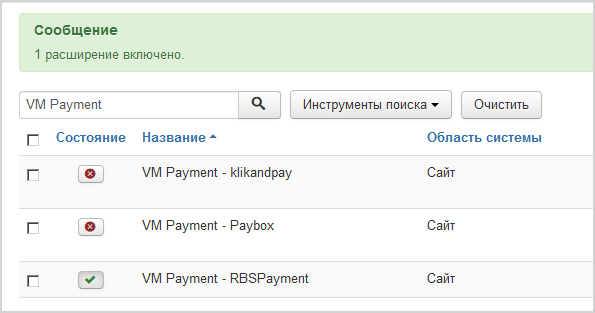

If successful, a corresponding message will be displayed (see image below).

- Proceed to configuring the plugin for VirtueMart.

Configuring the plugin for VirtueMart

To set up a payment plugin, follow these steps.

Installing and configuring the plugin is presented on Joomla! version 3.6.5 and VirtueMart version 3.2.0.

- Log in to your site's management console.

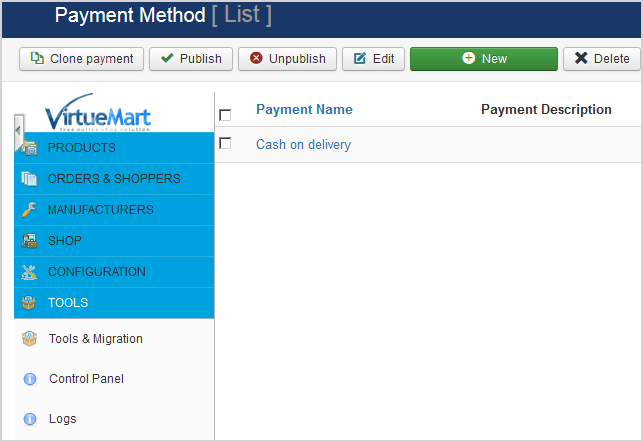

- From the top menu select VirtueMart > Payment Methods.

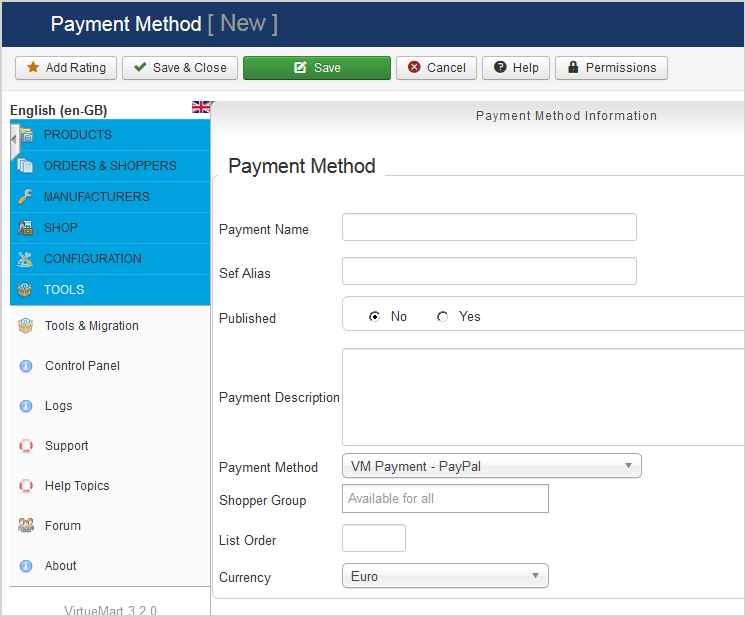

The following page will be displayed.

- Click on the New button.

The following page will be displayed.

- In Payment Namefield, enter the name of the payment method to be created, for example Sberbank.

- In the Payment Method list in the central part of the page, select VM Payment – RBSPayment Module.

- Click on the Save button on top.

- In the central part of the page, go to the Configuration tab of the created payment method.

The following form will be displayed

- Configure the settings using the table below.

Configuration Description LOGIN-API Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Test mode Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Two-phase payments Allows you to set the staging of payments – payments can be one-phase (do not require confirmation from the merchant) or two-phase (for the successful completion of the payment, the merchant must complete it, before that the funds will be held on the buyer's account).

Send cart data Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

- General;

- Simplified, income;

- Simplified, income minus expenses;

- Unified tax on imputed income;

- Unified agricultural tax;

- Patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Default VAT rate VAT rate. The following values are available:

- Without VAT;

- VAT rate of 0%;

- receipt VAT at rate of 10%;

- receipt VAT at rate of 18%;

- receipt VAT at the estimated rate of 10/110;

- receipt VAT at a calculated rate of 18/118;

- receipt VAT at rate of 20%;

- receipt VAT at calculated rate of 20/120.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Payment type Payment type. Possible values:

- Full pre-payment before the delivery date of the payment object.

- Partial pre-payment before the delivery date of the payment subject.

- Advance payment.

- Full payment at the time of transfer of the subject of payment.

- Partial payment for the settlement item at the time of its transfer with subsequent payment on credit.

- Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit.

- Payment for the subject of the settlement after its transfer with payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Type of item being paid for Type of item being paid for. Possible values:

- Product.

- excisable product.

- Work.

- Service.

- Gambling bet.

- Lottery ticket.

- Intellectual property.

- Payment.

- Agent's fee.

- Several subjects.

- Other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Payment type for delivery Payment type for delivery starting from 1.05

1– full pre-payment before the delivery date of the payment subject;2– partial pre-payment before the delivery date of the payment subject;- 3 – advance payment;

4– full payment on the delivery date of the payment subject;5– partial payment for the payment subject on the delivery date followed by payment on credit;6– delivery of the payment subject on the delivery date without payment followed by payment on credit;7– payment for the payment subject after its delivery using payment on credit.

- Click on the Save & Close button above the plugin edit form.

- Check the box next to the configured plugin and click the Publish button.

JoomShoppping

Downloading the plugin for JoomShopping

This tutorial assumes that your Joomla! the JoomShopping component is already installed.

Click on the button to download the plugin for JoomShopping.

The plugin supports fiscalization in accordance with the law 54-FZ.

Installing the plugin for JoomShopping

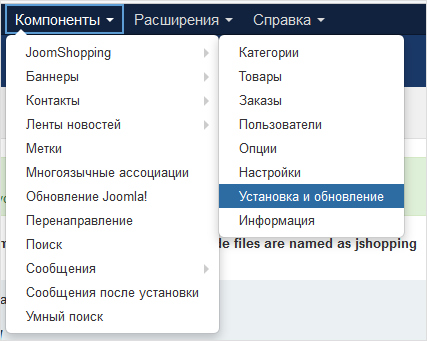

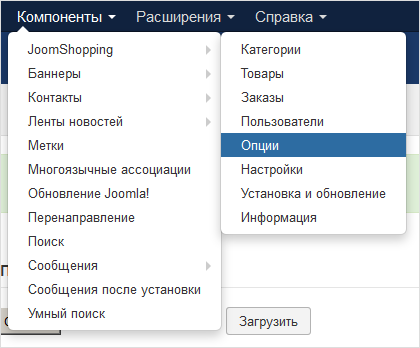

- In the top bar, select Components> JoomShopping> Install and Update (see image below).

The following page will be displayed.

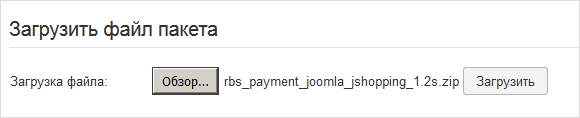

- In the Upload package file section, click on the Browse button, specify the path to the payment plugin file and confirm your choice.

The file name will be displayed on the screen (see image below).

- Click on the Upload button.

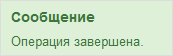

If the download is successful, the following message will be displayed.

- Proceed to setting up the payment plugin for JoomShopping.

~

Configuring the plugin for JoomShopping

To set up a payment plugin for JoomShopping, follow these steps.

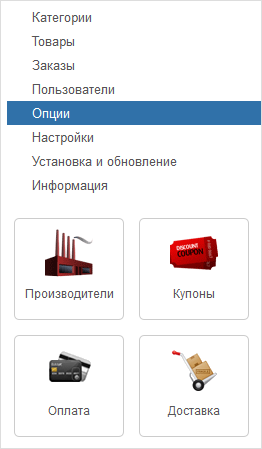

- In the top bar, select Components> JoomShopping> Options (see image below).

The following page will be displayed.

- Click on

(Payment).

(Payment).

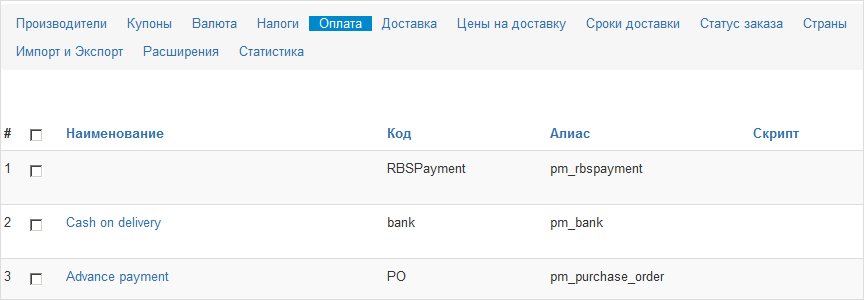

The following page will be displayed.

- Click on

(Edit) in the line with RBSPayment.

(Edit) in the line with RBSPayment.

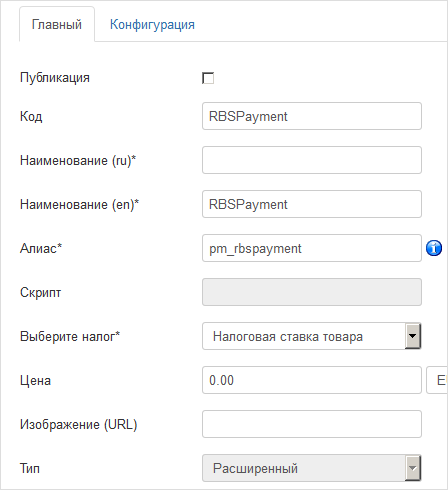

The following page will be displayed.

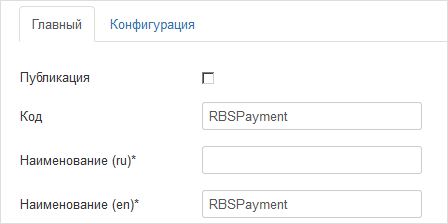

- On the Main tab make the following changes.

- Publication icon – if the checkbox is checked, the plugin is active, otherwise it is not used.

- Configuration | Name | - enter the name of the plugin as a payment method. For example, in the image below, you need to enter the name of the payment method in Russian.

- To configure the plugin, go to the Configuration tab .

The page will look like this.

- Configure the settings using the table below.

Configuration Description Status Allows to activate the module Merchant login Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Operation mode Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Payment phases Allows you to set the staging of payments – payments can be one-phase (do not require confirmation from the merchant) or two-phase (for the successful completion of the payment, the merchant must complete it, before that the funds will be held on the buyer's account).

Order status upon completion of payment What status will be displayed upon completion of the payment. Logging Allows you to enable or disable event logging.

Currency Payment currency. Settings for data transfer to OFD Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

- General;

- Simplified, income;

- Simplified, income minus expenses;

- Unified tax on imputed income;

- Unified agricultural tax;

- Patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

VAT rate VAT rate. The following values are available:

- Without VAT;

- VAT rate of 0%;

- receipt VAT at rate of 10%;

- receipt VAT at rate of 18%;

- receipt VAT at the estimated rate of 10/110;

- receipt VAT at a calculated rate of 18/118;

- receipt VAT at rate of 20%;

- receipt VAT at calculated rate of 20/120.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Fiscal documents format The list allows you to specify the used format of fiscal documents, the following options are available:

- FFD 1.0

- FFD 1.05

The format of the version must match the format selected in the personal account of the bank and in the account of the fiscalization service.

Payment type Payment type. Possible values:

- Full pre-payment before the delivery date of the payment object.

- Partial pre-payment before the delivery date of the payment subject.

- Advance payment.

- Full payment at the time of transfer of the subject of payment.

- Partial payment for the settlement item at the time of its transfer with subsequent payment on credit.

- Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit.

- Payment for the subject of the settlement after its transfer with payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Type of item being paid for Type of item being paid for. Possible values:

- Product.

- excisable product.

- Work.

- Service.

- Gambling bet.

- Lottery ticket.

- Intellectual property.

- Payment.

- Agent's fee.

- Several subjects.

- Other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

- Click on the Save and close button to save your changes and close the edit page.