WordPress

WordPress

With the installed payment plugin for WordPress, your customers will be able to pay with you through the payment page of «Sberbank».

For the payment plugin to work, the WooCommerce plugin must be preinstalled on WordPress. The payment plugin was tested for compatibility with the following versions of WordPress and WooCommerce (see the table below).

| Component | Version |

|---|---|

| WordPress | 4.x and higher |

| WooCommerce | 3.x |

Recommended version of WordPress for working with the Sberbank payment plugin: not lower than 4.8.3.

Starting from this version, the plugin allows you to transfer a shopping cart, which provides the possibility of detailed fiscalization in accordance with 54-FZ.

You can download the required version of WooCommerce on github.com (link leads to WooCommerce version history).

It is also recommended that you review the WordPress and WooCommerce documentation:

In this description, the following components and versions are used as an example:

- content management system WordPress version 4.7.3;

- plugin WooCommerce version 2.6.14.

The WooCommerce plugin is not compatible with all WordPress themes. Here, the Storefront theme is used as example. This theme is designed by WooCommerce developers.

Installing the plugin

- Upload the plugin folder to your website server in the following folder:

<site address>/wp-content/plugins/woocommerce-rbspayment/. - In the web interface of your site, log in to the console.

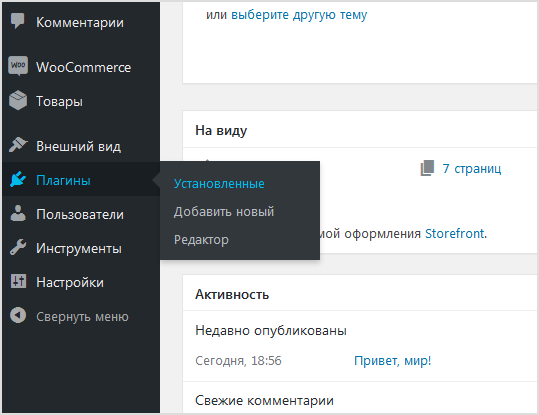

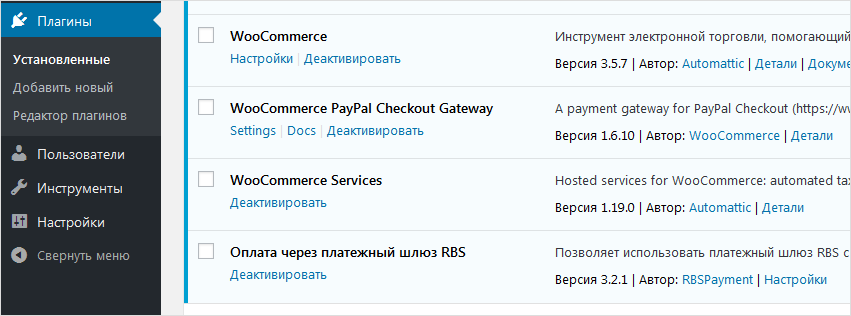

- In the left pane, select Plugins> Installed Plugins (see image below).

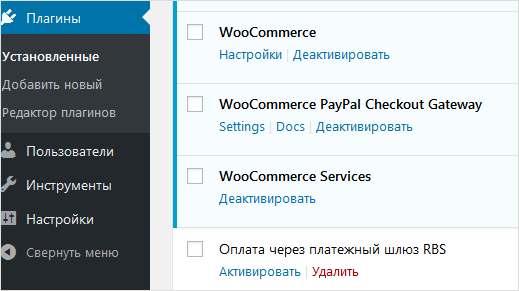

The page will look as follows.

- Click on the Activate link under the plugin named Payment via RBS payment gateway.

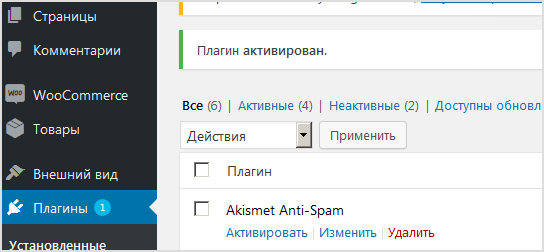

- A Plugin activated message appears in the system message area above (see image below).

Configuration

To set up a payment plugin for WordPress, follow these steps.

- In the web interface of your site, log in to the console.

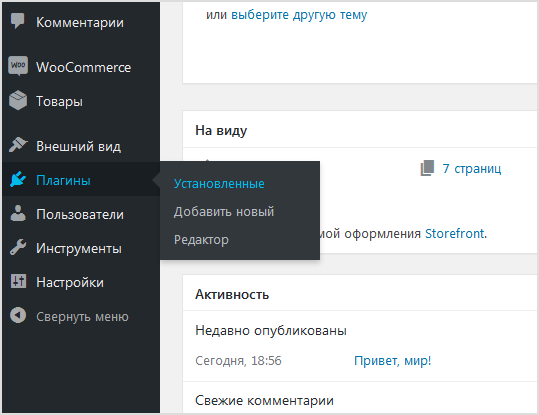

- In the left pane, select Plugins> Installed Plugins (see image below).

The page will look as follows.

- In the row RBSPayment Checkout Gateway, click on the link Settings.

The following page will be displayed.

- Configure the settings using the table below.

Configuration Description Enabled/Disabled The setting determines whether the plugin is enabled.

- the checkbox is checked – the plugin is enabled;

- the checkbox is not checked – the plugin is disabled.

Title The title that the user sees during the checkout process. Login-API Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Payments type Pick the payments type from the list. There are two options available:

- One-phase payments;

- Two-phase payments.

Test mode Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Description Enter a description of the payment method that will be displayed to the customer. Paid order status What status will be displayed after payment of the order. success_url The URL to which the user will be redirected in case of successful payment.

fail_url The URL to which the user will be redirected in case of unsuccessful payment.

Send cart data Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

- General;

- Simplified, income;

- Simplified, income minus expenses;

- Unified tax on imputed income;

- Unified agricultural tax;

- Patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Default VAT rate VAT rate. The following values are available:

- Without VAT;

- VAT rate of 0%;

- receipt VAT at rate of 10%;

- receipt VAT at rate of 18%;

- receipt VAT at the estimated rate of 10/110;

- receipt VAT at a calculated rate of 18/118;

- receipt VAT at rate of 20%;

- receipt VAT at calculated rate of 20/120.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Payment type Payment type. Possible values:

- Full pre-payment before the delivery date of the payment object.

- Partial pre-payment before the delivery date of the payment subject.

- Advance payment.

- Full payment at the time of transfer of the subject of payment.

- Partial payment for the settlement item at the time of its transfer with subsequent payment on credit.

- Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit.

- Payment for the subject of the settlement after its transfer with payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Payment type for delivery Payment type for delivery starting from 1.05

1– full pre-payment before the delivery date of the payment subject;2– partial pre-payment before the delivery date of the payment subject;- 3 – advance payment;

4– full payment on the delivery date of the payment subject;5– partial payment for the payment subject on the delivery date followed by payment on credit;6– delivery of the payment subject on the delivery date without payment followed by payment on credit;7– payment for the payment subject after its delivery using payment on credit.

Type of item being paid for Type of item being paid for. Possible values:

- Product.

- excisable product.

- Work.

- Service.

- Gambling bet.

- Lottery ticket.

- Intellectual property.

- Payment.

- Agent's fee.

- Several subjects.

- Other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

- Click Save changes.

A message will appear in the system notification area above Your settings are saved.

You can now accept payments.