Инструменты страницы

Simple payments

The available payment acceptance methods depend on settings configured for you. If in doubt, check with a Sberbank representative which method of accepting payments you can use.

Invoicing

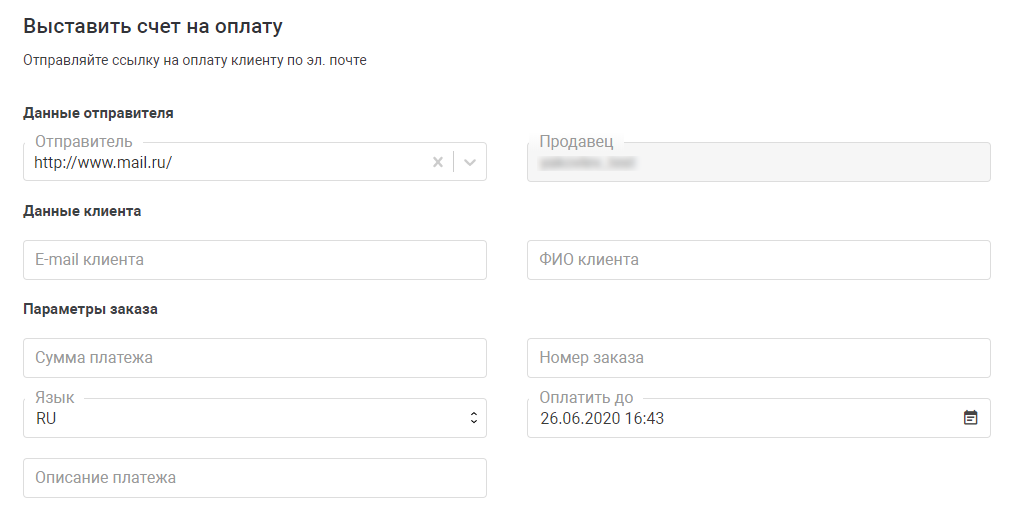

To issue an invoice, go to personal account, and in section Invoice to Email fill in several fields.

If the section Invoice to email the following message is displayed: “You do not have sufficient rights to send the payment form”, please contact the technical support service support@ecom.sberbank.ru with a request to activate the invoicing option. Make sure to include the following information in your request:

- operator login (used to enter your personal account).

- environment (test/production) for which changes need to be made

Below is the order of actions.

- Log in to your personal account (test environment/production environment) using the operator's login and from the left menu select the item Invoice.

- Fill in the fields using the table below.

Field name Description Sender Specify the sender that will be displayed to the buyer.

Merchant A field that is filled in automatically and cannot be edited. Client e-mail Specify the buyer's email address to which the cash receipt will be sent.

Most OFDs support delivery of receipt only to one email address. Some OFDs allow receipt delivery to multiple emails. In this case, the emails should be separated by commas without spaces. Contact your OFD for availability of receipt delivery to multiple emails.

Client name Enter the client's full name. Language Select the language in which the invoice letter will be sent. Pay until Indicate the date and time by which the payment should be made. You can enter data manually by clicking on the field with the mouse to select the date and time from the calendar. Payment amount Enter the order amount.

If an invoice is issued for an order in which a shopping cart is transferred, this field will be filled in automatically after the cart is formed.

Order number Enter the order number (identifier).

Description Enter a description for your order. Registration of an order with a shopping cart (manual formation of a cart)

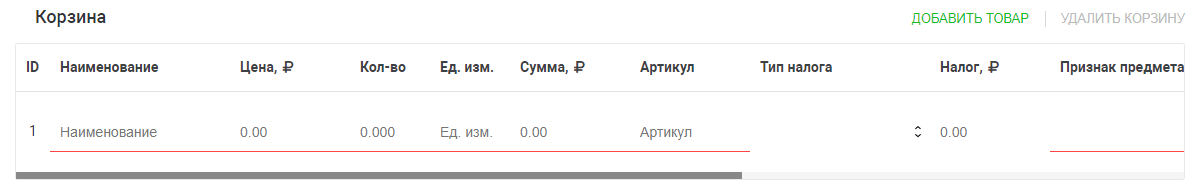

To add a new product to the cart, click on the ADD ITEM button in the Cart section (see image below).

The presence of some fields depends on the version of the fiscal document format used. Fill in the fields:

Field name Description ID Item identifier. Name Name of product. Price Unit cost. Qty Quantity of goods. Measure Units of measurement of the item. Amount The total cost for the entire quantity of goods. Article Article. Tax type Tax type, the list contains the following values:

- Without VAT;

- VAT rate of 0%;

- VAT rate of 10%;

- VAT calculated rate of 10/110;

- VAT rate of 20%;

- VAT calculated rate of 20/120.

Tax Tax amount. Sign of the subject of calculation The attribute of the subject of calculation, the list contains the following values:

- Product

- Excisable product

- Work

- Service

- Gambling bet

- Gambling winnings

- Lottery ticket

- Lottery winnings

- Intellectual property

- Payment

- Agent's fee

- Several subjects

- Other payment subject

- Property rights

- Non-operating income

- Insurance premiums

- Trade fee

- Resort fee

- Deposit

The following payment subject attributes are available only for FFD version 1.2

- Expense;

- Contributions for mandatory pension insurance for individual entrepreneurs

- Contributions for mandatory pension insurance

- Contributions for mandatory health insurance for individual entrepreneurs

- Contributions for mandatory health insurance

- Contributions for mandatory social insurance

- Casino payment

- Issuance of funds by a bank paying agent

- Excisable goods subject to labeling with an identification tool that does not have a marking code

- Excisable goods subject to labeling with an identification tool that has a marking code

- Goods subject to labeling with an identification tool that does not have a marking code, with the exception of excisable goods

- Goods subject to labeling with an identification tool that has a marking, with the exception of excisable goods

Payment method attribute Payment method attribute, the list contains the following values:

- Full prepayment before the transfer of the subject of payment;

- Partial advance payment until the transfer of the subject of payment;

- Advance payment;

- Full payment at the time of transfer of the subject of payment;

- Partial payment of the settlement item at the time of its transfer with subsequent payment on credit;

- Transfer of the subject of settlement without payment at the time of its transfer with subsequent payment on credit;

- Payment for the subject of settlement after its transfer with payment on credit;

Excise tax Indirect tax. Code of the country Country of origin code. Number of customs declaration Number of customs declaration. Registering an order with a shopping cart (loading CSV with a shopping cart)

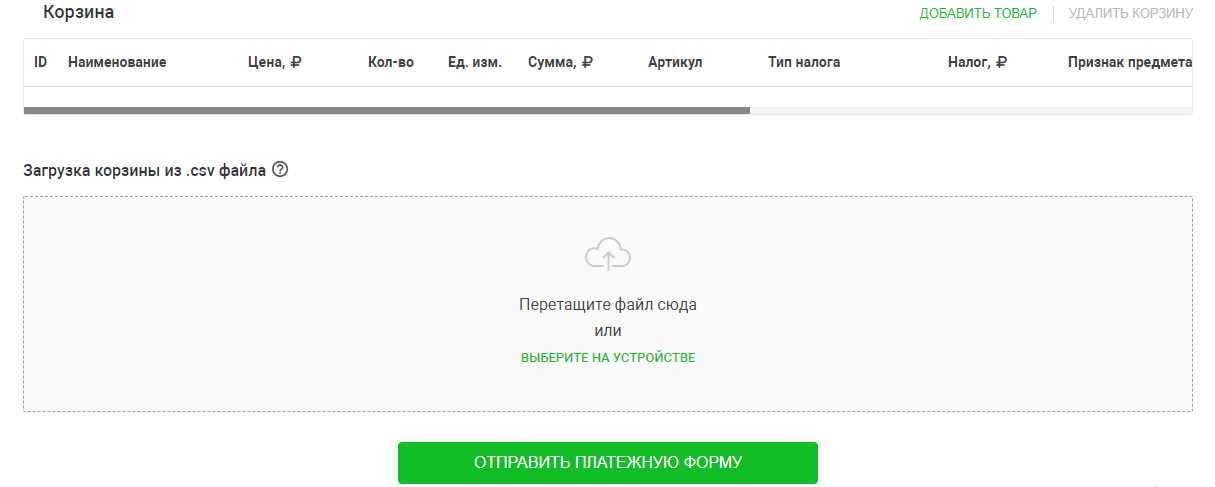

To load a shopping cart, upload the required file in the Loading cart from .csv file section under the form for filling in customer data.

Click on the Submit payment form button. Upon successful registration of the order, an email containing a link to the payment page will be sent to the specified e-mail address of the buyer.

If you set the invoice validity period too short, the client will not be able to use the same invoice to pay for the order after some time.

You can use test cards to try out the functionality.

{(rater>id=rater29|name=Was this page helpful?|type=vote)}

Payment by static link

The easiest way to accept payment is to give the buyer the opportunity to click on a regular link and enter the amount, payment purpose and bank card details on their own. The merchant generates a link that leads to the payment page. This link can be:

- place on the store's website;

- send to the buyer by email;

- send to the buyer using the instant messaging system (WhatsApp, Telegram, Viber, etc.);

- post on social networks.

The buyer follows the link to the payment page, enters bank card details and transfers funds. This method of connection does not require programming skills or your own website.

Generating a payment link using a generator

The Account for the messenger section will allow you to expand the list of payment acceptance methods that do not require time-consuming integration.

To create a link to pay using the payment link generator, follow these steps.

Go to the link creation web page from your personal account (test environment/production environment), Invoice for messenger section.

Click on the Go to generator button.

The following page will be displayed.

Fill in the fields with values:

| Setting/Field | Description | Mandatory |

|---|---|---|

| Payment amount | The order amount. | No |

| Description | Description of the order in any format. | No |

Whether or not to display an email input field | Yes | |

| Full name |

Whether or not to display a field for entering the last name, first name | No |

| Telephone |

Whether or not to display a field for entering the number | No |

| Delivery address |

Whether or not to display a field for entering an address | No |

To create an additional field that will be displayed on the payment page, click on the ADD FIELD button and enter the name of the new parameter, under which the field will be displayed on the payment page.

Default payment link lifetime is 6 months from creation or last payment.

To check the functionality of the generated link, copy and paste it into the address bar of your browser. After that, a ready-made payment form will be displayed.

You can use test cards to try out the functionality.

Example of payment link

Here is an example of a link with dynamic parameters for payment – the client needs to enter the amount and email.

Below is an example of the link code.

<a target="_blank" href="https://3dsec.sberbank.ru/payment/docsite/payform-1.html?token=YRF3C5RFICWISEWFR6GJ&ask=amount&ask=email&ask=description"> Pay for services </a>

You can use test cards to try out the functionality.

{(rater>id=rater18|name=Was this page helpful?|type=vote)}