Инструменты страницы

Drupal

With the installed plugin for Drupal, your customers will be able to pay with you through the payment page of «Sberbank». For the payment plugin to work, the Drupal Commerce module must be preinstalled in Drupal.

In the Drupal interface, add-ons are called «modules». The payment plugin falls into the same category, however the term «plugin» is used in this description.

System requirements

The payment plugin was tested on the following versions of Drupal and the Drupal Commerce module.

| Drupal version | Drupal Commerce version | Links to instructions |

|---|---|---|

| 7.x | 1.13 | |

| 8.x | 2.x |

Installing the plugin for Drupal 7.x Drupal Commerce 1.13

To install the payment plugin for Drupal, follow these steps.

- Unpack the archive and place the plugin folder in the following path:

<site folder>\modules\.

- Sign in to your online store website.

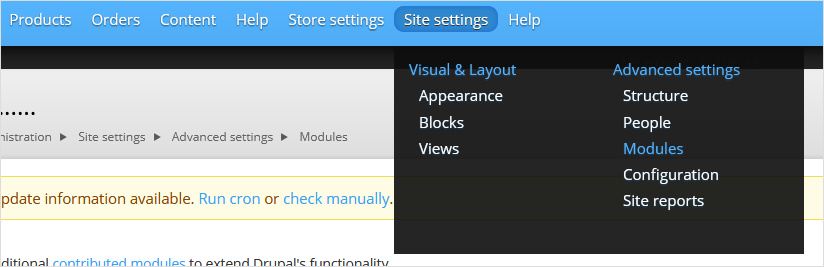

- In the top bar of the site, select Site settings > Advanced settings > Modules (see image below).

The following page will be displayed.

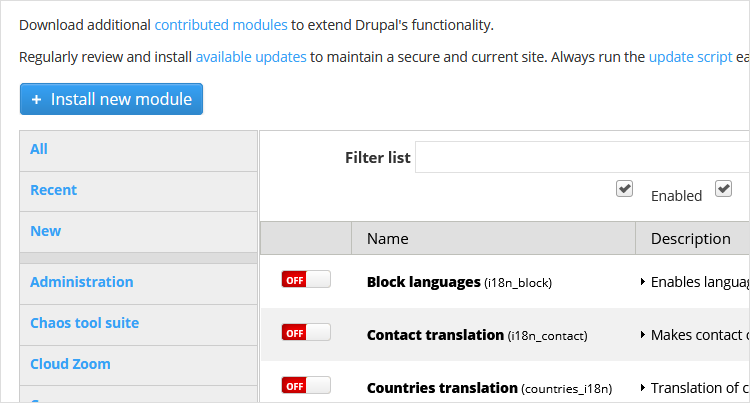

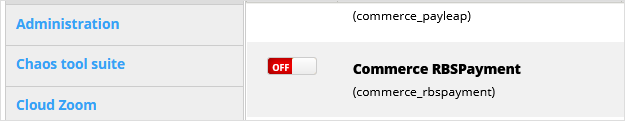

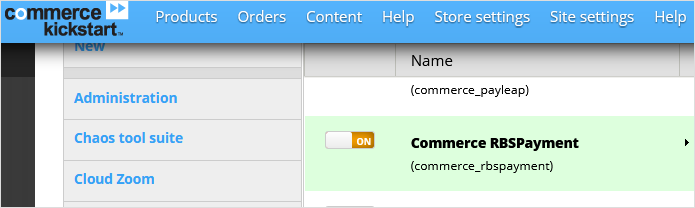

- Find the plugin in the table: Commerce RBS Payment (see image below).

- Click to move the radio button from OFF to position ON – See image below.

- Click on the Save configuration button in the lower left corner of the page.

Configuring the plugin for Drupal 7.x Drupal Commerce 1.13

To set up a payment plugin for Drupal, follow these steps.

- Log in to your payment store website.

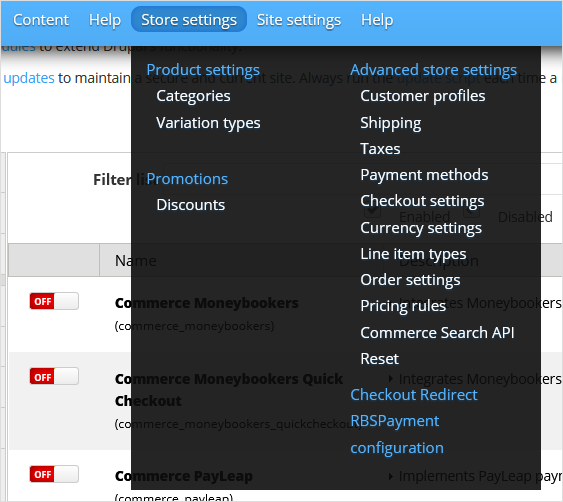

- From the top menu, select Store settings > RBS payment configuration (see image below).

The following page will be displayed.

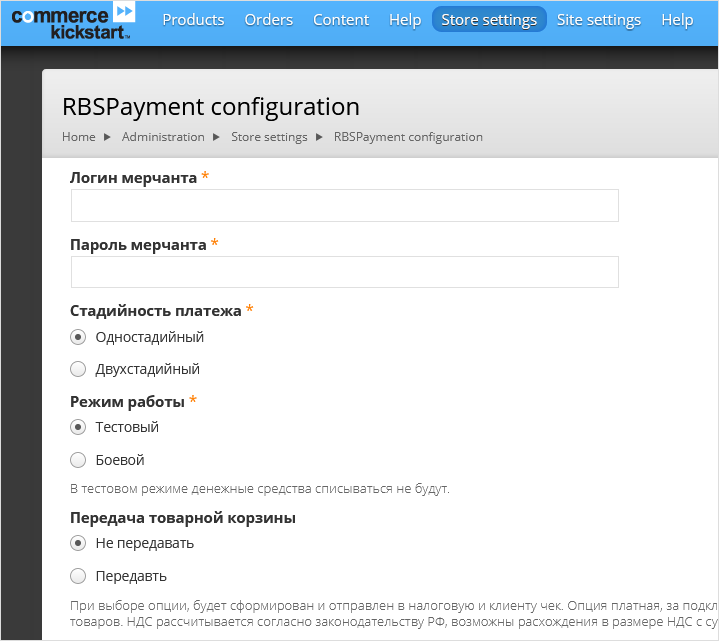

- Configure the settings using the table below.

Configuration Description Merchant login Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Merchant password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Payment phases - One-phase – payments will be made according to a one-phase scheme;

- Two-phase – payments will be made according to a two-phase scheme.

Working hours Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Passing the shopping cart data Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

- General;

- Simplified, income;

- Simplified, income minus expenses;

- Unified tax on imputed income;

- Unified agricultural tax;

- Patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Fiscal documents format The list allows you to specify the used format of fiscal documents, the following options are available:

- FFD 1.0

- FFD 1.05

The format of the version must match the format selected in the personal account of the bank and in the account of the fiscalization service.

Payment type Payment type. Possible values:

- Full pre-payment before the delivery date of the payment object.

- Partial pre-payment before the delivery date of the payment subject.

- Advance payment.

- Full payment at the time of transfer of the subject of payment.

- Partial payment for the settlement item at the time of its transfer with subsequent payment on credit.

- Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit.

- Payment for the subject of the settlement after its transfer with payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Type of item being paid for Type of item being paid for. Possible values:

- Product.

- excisable product.

- Work.

- Service.

- Gambling bet.

- Lottery ticket.

- Intellectual property.

- Payment.

- Agent's fee.

- Several subjects.

- Other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Logging requests to the payment gateway - No – event logging is disabled;

- Yes – event logging is enabled.

- Click on the Save configuration button.

Installing the plugin for Drupal 8.x Drupal Commerce 2.x

To install the plugin, follow these steps.

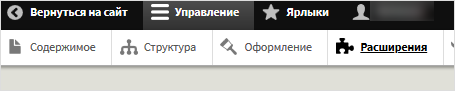

- From the top menu select Manage > Extend (see image below)

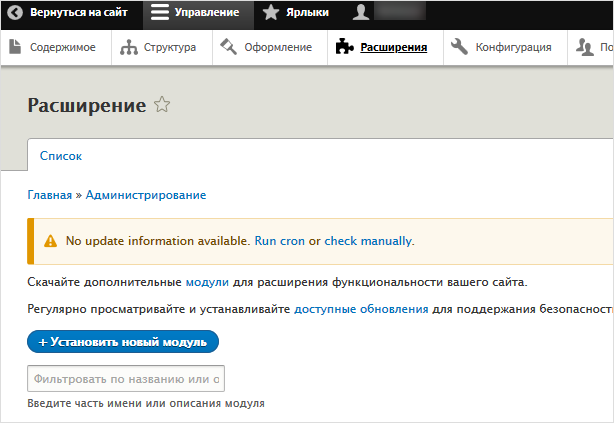

The following page will be displayed.

- Click on the Install new module button.

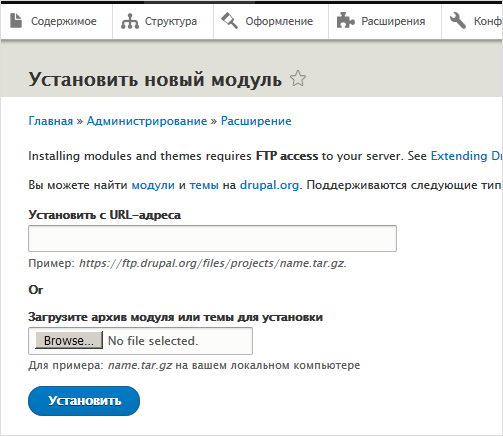

The following page will be displayed.

- In the Upload a module or theme to install field, click on the Browse button and specify the path to the plugin file.

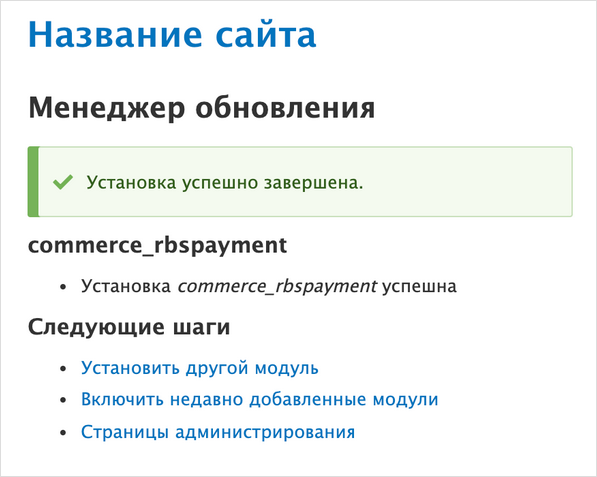

If the installation is successful, the following message will be displayed.

- Enable the installed module – Commerce RBSPayment (see image below).

Configuring the plugin for Drupal 8.x Drupal Commerce 2.x

To configure the plugin, follow these steps.

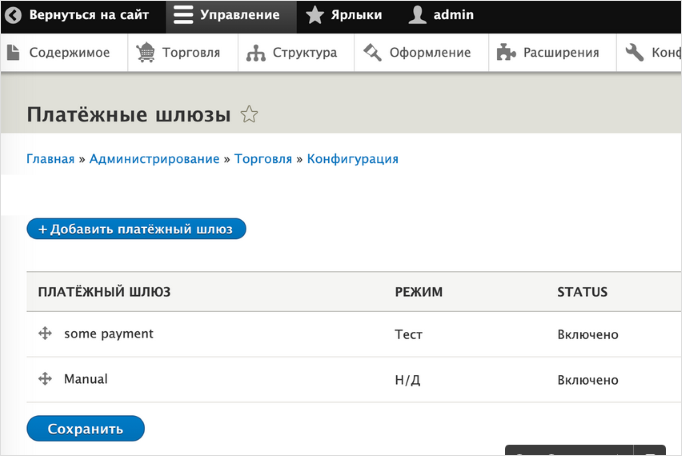

- From the top menu select Manage> Commerce>Configuration> Payment> Payment gateways.

The following page will be displayed.

- Click on the Add payment gateway button.

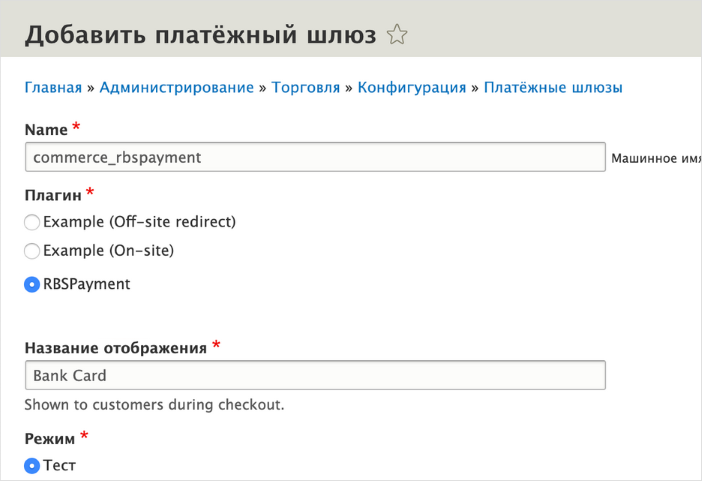

The following page will be displayed.

- Select RBSPayment

- Configure the settings using the table below.

The description contains only those settings that relate directly to the payment plugin. The rest of the settings are related to the content management system (CMS).

Configuration Description Display name Payment method name, for example: Payment by credit card.

Mode Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Login-API Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Two-phase payments Allows you to set the staging of payments – payments can be one-phase (do not require confirmation from the merchant) or two-phase (for the successful completion of the payment, the merchant must complete it, before that the funds will be held on the buyer's account).

Send cart data Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

- General;

- Simplified, income;

- Simplified, income minus expenses;

- Unified tax on imputed income;

- Unified agricultural tax;

- Patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

Fiscal documents format The list allows you to specify the used format of fiscal documents, the following options are available:

- FFD 1.0

- FFD 1.05

The format of the version must match the format selected in the personal account of the bank and in the account of the fiscalization service.

Payment type Payment type. Possible values:

- Full pre-payment before the delivery date of the payment object.

- Partial pre-payment before the delivery date of the payment subject.

- Advance payment.

- Full payment at the time of transfer of the subject of payment.

- Partial payment for the settlement item at the time of its transfer with subsequent payment on credit.

- Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit.

- Payment for the subject of the settlement after its transfer with payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Type of item being paid for Type of item being paid for. Possible values:

- Product.

- excisable product.

- Work.

- Service.

- Gambling bet.

- Lottery ticket.

- Intellectual property.

- Payment.

- Agent's fee.

- Several subjects.

- Other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Write log file Allows you to enable or disable event logging.

Status Determines if the plugin is enabled.

- Save your changes.