Инструменты страницы

UMI.CMS

With the installed plugin for UMI.CMS, your customers will be able to pay with you through the payment page of Sberbank.

Installation

To install the plugin for UMI.CMS, follow these steps.

- Copy the contents of the

uploadfolder from the payment plugin archive to your website directory. - In a browser, open the page <your site address>/rbspayment_installer.php.

After successful installation of the plugin, a page with a message will be displayed RBSPayment installed successfully! (the page should be rendered in Unicode encoding). - Proceed to plugin setup.

Configuration

To configure the plugin for UMI.CMS, follow these steps.

- Log in to the admin panel of your online store.

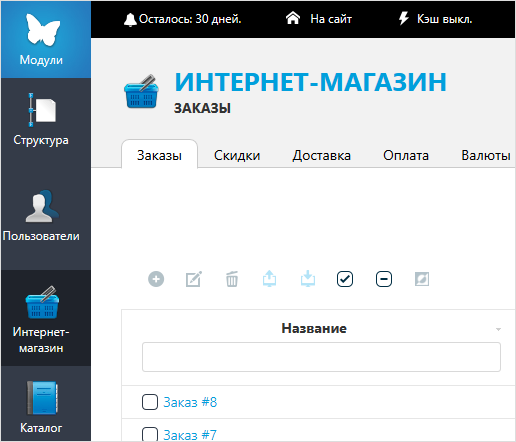

- In the left menu, select Emarket.

The following page will be displayed.

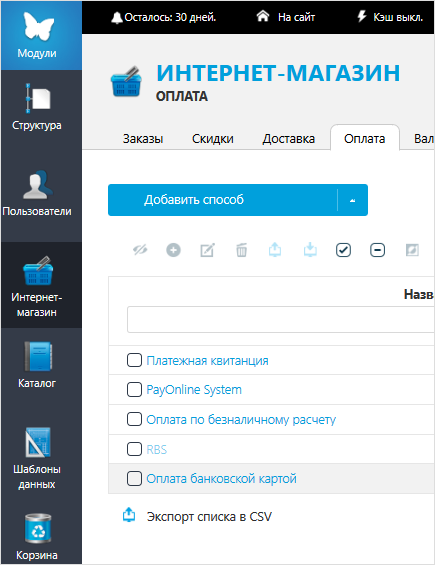

- Select the Payments tab.

The page will look as follows.

- Do one of the following:

- If this is your first time configuring a plugin, click the Add method button above the list of payment methods.

- If you have already added the payment method for UMI.CMS plugin, click on

in the line with the name of the payment method you specified earlier.

in the line with the name of the payment method you specified earlier.

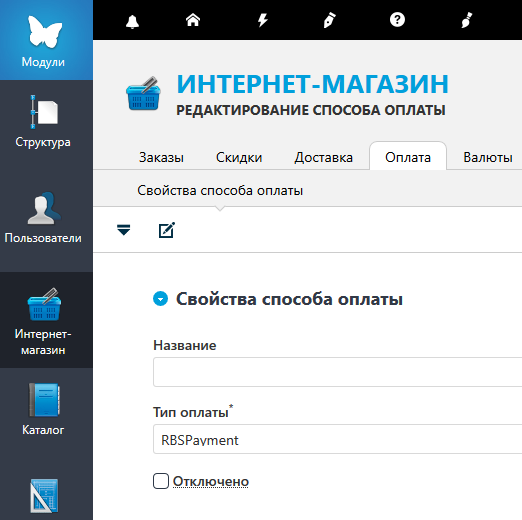

The following page will be displayed.

- Configure the settings using the table below.

Configuration Description Payment properties section Name Payment method name, for example: Payment by credit card.

Payment type Select (or leave selected) RBSPayment. Disabled Determines if the plugin is enabled.

Parameters section Login Login of a service account in a payment gateway with a suffix -api.

If the plugin is running in test mode, you should specify the login for the test user account. If the plugin is running in production mode, you should specify the password for the production user account.

Password The password for the service account in the payment gateway.

If the plugin is running in test mode, you should specify the password for the test user account. If the plugin is running in standard (production) mode, you should specify the password for the production user account.

Test mode Allows you to set the plug-in operation mode: test or live (working).

- If the plugin is running in test mode, in the respective fields (Login and Password) you should specify the data of the test service account.

- If the plugin works in the live mode, in the respective fields (Login and Password) you should specify the data of the live service account.

Two-phase payments Allows you to set the staging of payments – payments can be one-phase (do not require confirmation from the merchant) or two-phase (for the successful completion of the payment, the merchant must complete it, before that the funds will be held on the buyer's account).

Send data to generate a receipt Allows you to choose whether the shopping cart will be sent and whether a sales receipt will be generated. To be able to use this functionality, please contact your bank representative. For more details see section on compliance with law 54-FZ.

Taxation scheme Tax system. The following values are available:

0– general;1– simplified, with only revenue taken into account;2– simplified, the revenue minus the expenditure;3– unified tax on imputed income;4– unified agricultural tax;5– patent tax system.

This setting is applied only if you have configured fiscalization parameters – see details in section on compliance with law 54-FZ.

fiscal documents format The list allows you to specify the used format of fiscal documents, the following options are available:

v100– FFD 1.0;v105– FFD 1.05.

The format of the version must match the format selected in the personal account of the bank and in the account of the fiscalization service.

Payment type Payment type. Possible values:

1– full pre-payment before the delivery date of the payment subject;2– partial pre-payment before the delivery date of the payment subject;- 3 – advance payment;

4– full payment on the delivery date of the payment subject;5– partial payment for the payment subject on the delivery date followed by payment on credit;6– delivery of the payment subject on the delivery date without payment followed by payment on credit;7– payment for the payment subject after its delivery using payment on credit.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Type of item being paid for Type of item being paid for. Possible values:

- 1 – product;

- 2 – excisable product;

- 3 – work;

- 4 – service;

- 5 – gambling bet;

- 7 – lottery ticket;

- 9 – intellectual property;

- 10 – payment;

- 11 – agent's fee;

12– several subjects;- 13 – other payment subject.

The settings are effective only if the format of fiscal documents of version 1.05 and higher is selected.

Enable logging Allows you to enable or disable event logging.

- Do either of the following, depending on whether it is the first time you are configuring the plugin or not:

- If this is your first time editing the plugin, click the Add and exit button in the lower right corner of the page.

- If this is your first time editing a plugin, click the Save and exit button in the lower right corner of the page.

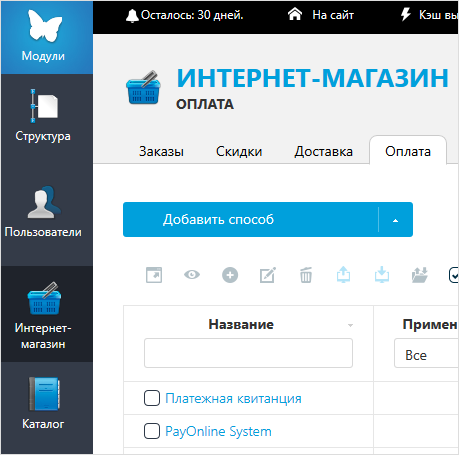

The created/edited method will be displayed in the list of payment methods (see image below).